STAMP DUTY LAND TAX

Reforms were introduced to the charging provisions for non-residential property.

The stamp duty land tax (SDLT) charged on purchases of non-residential properties

and transactions involving a mixture of residential and non-residential properties is to

change for transactions on or after 17 March 2016.

Thereafter SDLT will be charged at each rate on the portion of the purchase price which

falls within each rate band. The new rates and thresholds are as follows:

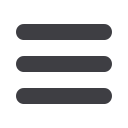

Transaction value band

Rate

£0-£150,000

0%

£150,001 - £250,000

2%

£250,001 +

5%

For new leasehold transactions, SDLT is already charged at each rate on the portion

of the net present value (NPV) of the rent which falls within each band.

On and after 17 March 2016 a new 2% rate for rent paid under a non-residential lease

will be introduced where the NPV of the rent is above £5 million.

The new rates bands and thresholds for rent paid under a lease are:

Net present value of rent

Rate

£0-£150,000

0%

£150,001 - £5,000,000

1%

£5,000,000 +

2%

Higher rates of SDLT will be charged on purchases of additional residential properties, such

as second homes and buy-to-let properties. The higher rates will be 3 percentage points

above the current SDLT rates:

Thresholds

Existing SDLT rates New additional

property SDLT rates

£0-£125,000

0%

3%

£125,001-£250,000

2%

5%

£250,001-£925,000

5%

8%

£925,001-£1,500,000

10%

13%

Over £1,500,000

12%

15%

The announcement also provides arrangements where there is a period of overlap or a gap

in ownership of a main residence.

Companies purchasing residential property will be subject to the higher rates, including

the irst purchase of a residential property. Properties purchased for under £40,000,

caravans, mobile homes and houseboats will be excluded from the higher rates.

CLIMATE CHANGE LEVY

Rates for the climate change levy (CCL) are to increase for 2017/18, 2018/19

and 2019/20. The CCL main rates will increase in line with RPI.

These increases are partly intended to replace tax revenues lost as a result of the abolition

of carbon reduction commitment energy eficiency scheme. The reduced rates of CCL for

qualifying businesses in the climate change agreement scheme will be amended

11

| Duties

DUTIES

so participants will not pay more CCL

than they would under the currently

expected RPI increase for that year.

FUEL DUTY

The main rate of fuel duty for both petrol

and diesel are to remain frozen

at 57.95 pence per litre.

VEHICLE EXCISE DUTIES

Vehicle excise duty rates are to be

maintained in real terms by increasing

the duty by the RPI. This is a consistently

applied policy as rates have increased

in line with inlation since 2010. The next

increase in rates will apply on 1 April 2016.

EXEMPTION FOR CLASSIC

VEHICLES

A 40 year rolling exemption for classic

vehicles was announced in Budget 2014.

Budget 2016 now makes this a permanent

exemption for classic vehicles so that on

1 April each year vehicles constructed more

than 40 years before 1 January that year

will automatically be exempt from paying

vehicle excise duty. It is reported that there

are around 10,000 classic vehicle owners.

FUEL DUTY

REMAINS

FROZEN